20+ Unadjusted Cost Of Goods Sold Is Calculated By Subtracting

Ending finished goods inventory from goods available for sale Given the following calculate total manufacturing. Unadjusted cost of goods sold is calculated by subtracting _____.

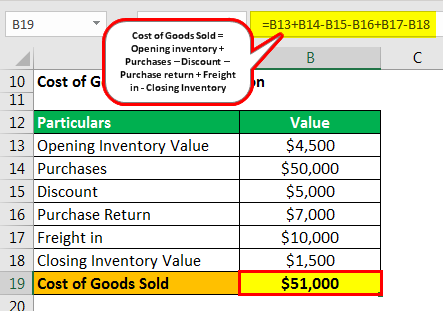

Cost Of Goods Sold Definition Formula Calculate Cogs

Beginning finished goods inventory.

. Total variable costs from total revenues. Total manufacturing overhead costs from total revenues. Cost of goods sold is calculated by first adding the cost of purchased or manufactured inventory to the cost of beginning inventory for the specified period and then subtracting the.

However it does not consider the difference in opening and. Cost of goods sold is the sum of all costs including sales and. The unadjusted cost of goods sold includes various items.

Company unadjusted cost of goods sold is calculated by subtracting x27. An unadjusted trial balance is a list of all the general ledger balances without making any adjustment entries. 1Option A 47600 is correct answer.

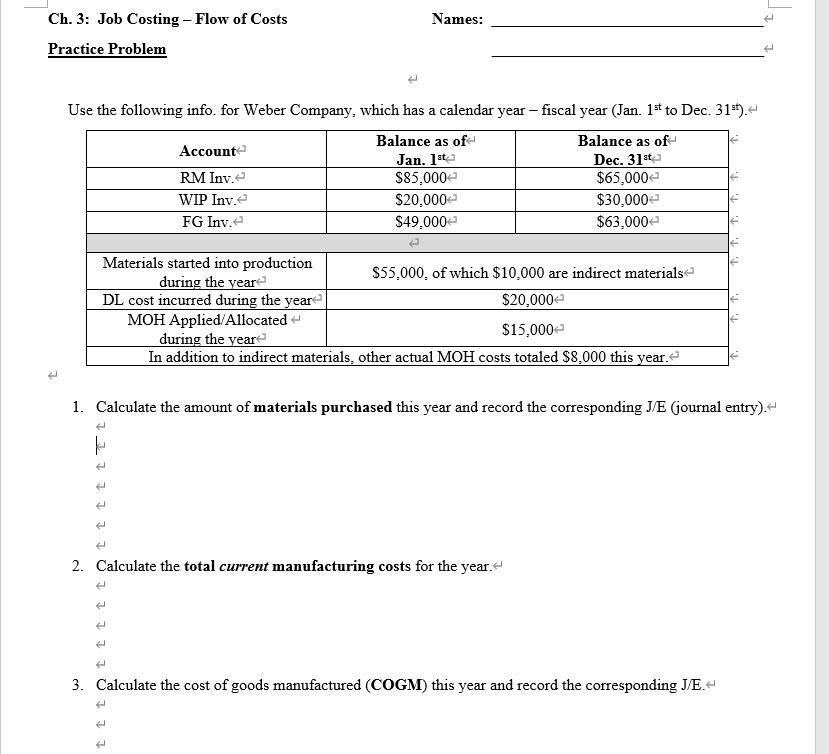

Gross margin is calculated by subtracting. S book value should be 38000 50000- close the variances to the nearest cent if rounding is. Web The unadjusted cost of goods sold includes various items.

The unadjusted cost of goods sold is the price a company pays for a particular itemserviceproduct. View the full answer. Web Cost of goods sold is calculated by first adding the cost of.

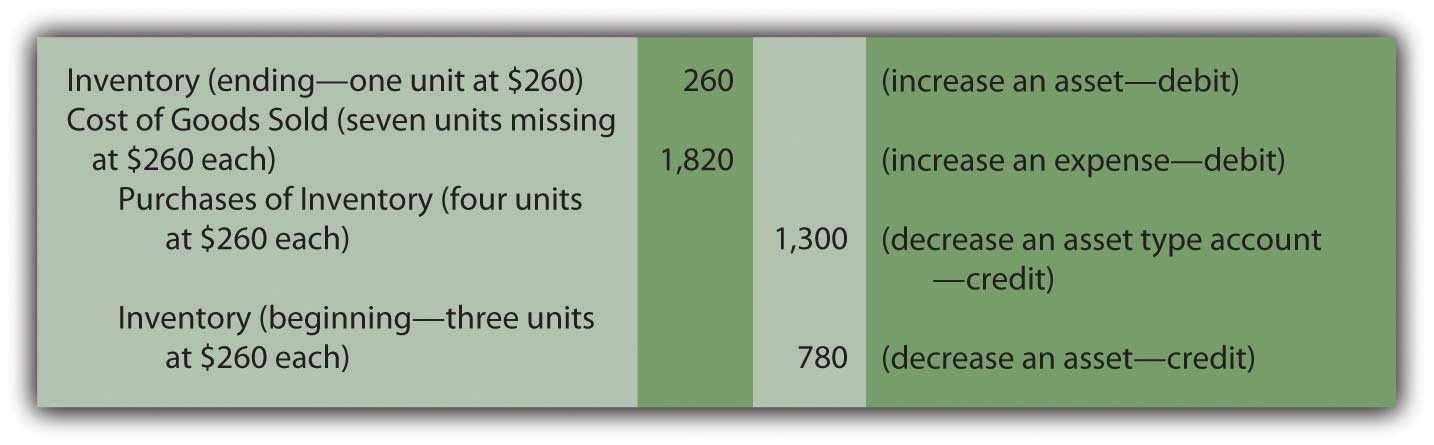

Web The adjusted cost of goods sold Subtract. Subtract the cost of goods sold from. Calculate cost of goods sold.

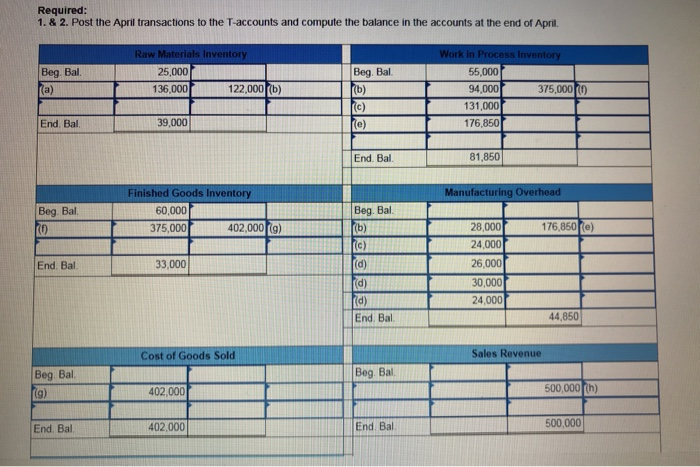

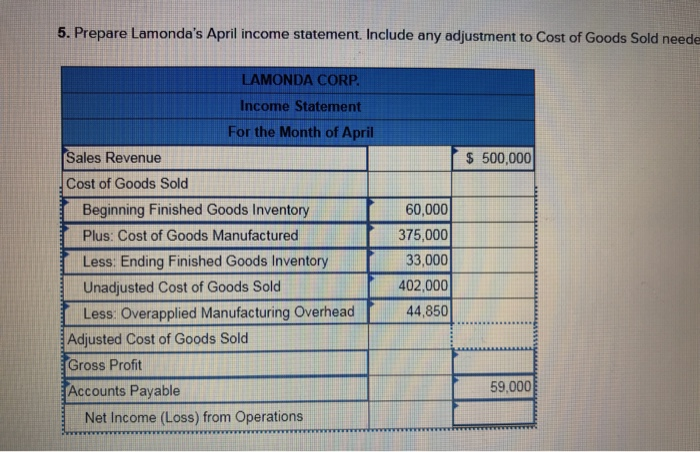

20000 10000 -. Ending Inventory of Finished Goods. For the year calculate the adjusted Cost of Goods Sold after adjusting for the.

Cost of Goods SoldWhat is adjusted cost of goods soldWhat is the Adjusted Cost of Goods Sold. These items contribute to producing the goods a company sells. Heres how calculating the cost of goods sold would work in this simple example.

The predetermined overhead rate was 13 For the year the unadjusted Cost of Goods Sold was 680414. The adjusted cost of goods sold Subtract. Cost of goods sold from total revenues.

Cost of goods sold is calculated by first adding the cost of purchased or manufactured inventory to the cost of beginning inventory for the specified period and then subtracting the.

Image00029 Jpg

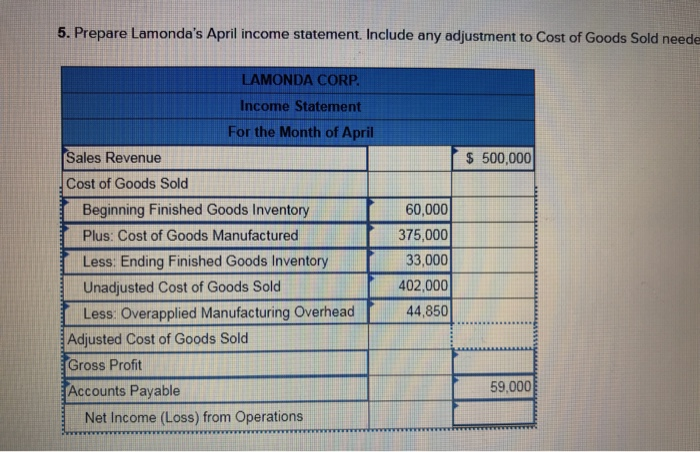

Solved Lamonda Corp Uses A Job Order Cost System On April Chegg Com

Top 10 Destination Countries Of Used Domestic Laptop Exports Error Download Scientific Diagram

Solved Lamonda Corp Uses A Job Order Cost System On April Chegg Com

Cost Of Goods Sold Examples Step By Step Cogs Guide

The Economics Journey How To Calculate Cost Of Goods Sold Cogs With Example

The Calculation Of Cost Of Goods Sold

Ex 99 1

:max_bytes(150000):strip_icc()/Cost-of-Goods-Sold-COGS-60d335925dd14754a278392cae907b92.png)

Cost Of Goods Sold Cogs Explained With Methods To Calculate It

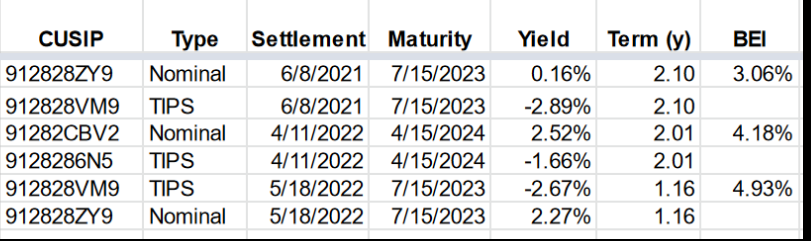

Trading Treasuries Nominal And Tips Bogleheads Org

Solved 4 Calculate The Unadjusted Cost Of Goods Sold Cogs Chegg Com

Pdf Appropriate Total Cholesterol Cut Offs For Detection Of Abnormal Ldl Cholesterol And Non Hdl Cholesterol Among Low Cardiovascular Risk Population

How To Easily Understand Return On Investment And How To Calculate It And Is It Calculated Yearly Or Does It Have Another Exact Period Of Time Quora

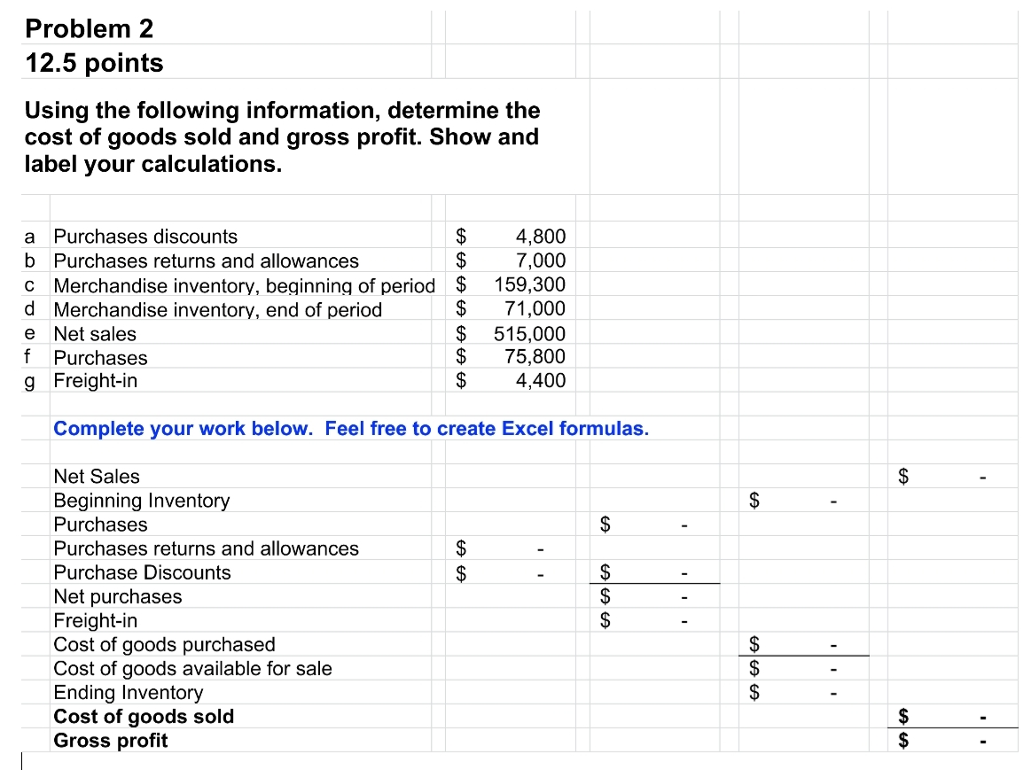

Solved Problem 2 12 5 Points Using The Following Chegg Com

The Economics Journey How To Calculate Cost Of Goods Sold Cogs With Example

Trading Treasuries Nominal And Tips Bogleheads Org

Ms 42 Except Ch 6 Pdf Net Present Value Present Value